Crypto-currencies together with the block-system bring a lot of new to the ordinary life of people. They brought a lot of benefits that had not been so prevalent before and had not existed at all. There were prerequisites, but the block system with crypto assets could combine all the pluses and introduce the system to ensure maximum security and efficiency in the digital environment. Blokchein brought the opportunity to conduct fast operations in the network, innovative decentralized technology and a number of profitable and profitable solutions for the business environment. The Quickx project will allow the transfer of multiple crypto-currencies of different types between the parties. One of the advantages of the platform is speed. The project will ensure rapid implementation of results without charging high commissions.

Quickx is developed by Secugenius. This is a well-known organization that works in the field of cybersecurity in the territory of India. It represents reliable services and services to create an information-safe environment. This company has won a large number of awards and made a number of innovations in its industry. Now the organization creates a promising decentralized platform Quickx.

The Problem Statement

QuickX identifies the following problems, within existing blockchain ecosystems that can hinder the mass adoption of blockchain assets as a medium of exchange for day-today transactions:

Time & Speed

Blockchain transactions are recorded in the blockchain as blocks. Most blockchain protocols have a limited block size, and take a certain amount of time to generate a block. For instance, Bitcoin blockchain takes an average of 10 minutes before a transaction receives a network confirmation. Ethereum takes 10 to 19 seconds. This places technical limits on the number of transactions that the blockchain can process per second. For instance, Ethereum can process 20 transactions per second while Bitcoin manages just 07 transactions per second. Conversely, most traditional centralized systems are much faster than decentralized systems. For example, Paypal manages 193 transactions per second1 and Visa can manage up to 56,000 transactions per second2.

Transaction Cost

One way to reduce these transaction fees is to remove the intermediaries. This doesn’t eliminate transaction fees altogether; even if intermediaries are removed from a blockchain transaction, there will still be a transaction cost involved in the process.

The nodes in a blockchain ecosystem offer computer processing power to service the network, and need to be compensated in exchange for their service – typically in cryptocurrency. This gives rise to transaction fees. Although blockchain transaction costs are lower than those of the banking system in most cases, they can still be a significant amount depending on the blockchain type, and the urgency of the transaction. For instance, current Bitcoin fees per transaction range from USD 20 to USD 30 while Ethereum fees per transaction range from USD 2 to USD 3.

Scalability

Almost all blockchain protocols, be it Bitcoin, Ethereum, or Ripple, have one common limitation in scalability: each node or the computer on the blockchain needs to process every transaction.

This requires each node to possess and maintain a copy of the entire ledger. Although decentralization is a key blockchain concept that results in many benefits such as removal of intermediaries, permanence, security, and transparency, it comes at the expense of scalability.

Scalability in traditional database systems can be easily solved with more computing power by adding more physical server computers. In the case of a decentralized system, each of the multiple processing nodes would, in theory, require more physical components to increase computing power.

Scalability on this level is impractical; expanding the blockchain would increase the need for processing power, storage, and bandwidth at each node, and not all fully participating nodes may be able to cope with the increased requirements.

Cross Chain Transfers

Due to different blockchains having different protocols, there are limited ways in which communication between two can take place. For instance, should a sender who owns crypto assets in the Bitcoin blockchain want to transfer assets to a receiver on the Ethereum blockchain, the sender would first need to convert the Bitcoin crypto assets into Ethereum crypto assets. At that point, the sender may be required to transfer the Ethereum crypto assets to a wallet that supports it. Only then will the sender be able to transfer the assets to the receiver. This process is often tedious, time-consuming, and costly. It is often said that connecting different blockchains would be key to mass adoption of blockchain ecosystems that is comparable to forming internet in the 1990 by connecting different intranets through TCP/IP protocol.

QuickX solves the above problems by building a decentralized platform that provides a solution to time, cost, and scalability by doing the transactions off the chain for same blockchain assets and having pooling Facilitators who are providing liquidity for cross chain transfer of Crypto Assets.

QuickX aims to change the status of cryptocurrency from a share-like object to real spendable currency that would be appealing to the masses. It provides an instant payment option for the users while opening up new untouched segments of business for the pooling facilitators.

QUICKX ARCHITECTURE

First and foremost, Quickxis designed to solve critical problems in blockbuster technology. The most important of them is the time and speed of transactions, the cost of the operation, that is, the commission charged by the service, as well as the problems with scalability. The new platform will include a multi-currency purse, a debit card and a payment gateway. The site being developed is a new and more powerful approach in the field of conducting crypto-currency transactions.

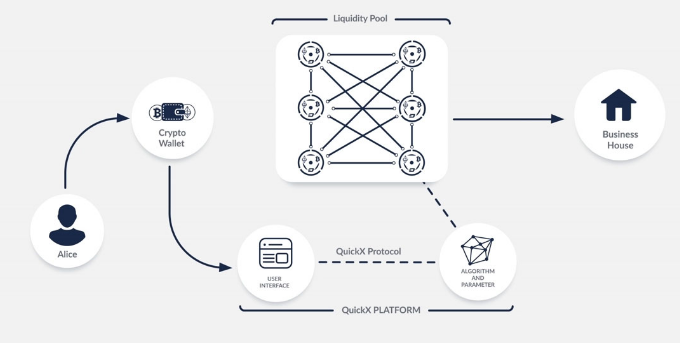

The project technology is built around the work of the pool of liquidity. This is where a number of transactions occur. In particular, with bitcoin, etherium and other crypto-currencies. The pool interacts with the business environment, providing it with a number of useful functions for effective operations. Works with specially developed algorithms Quickx. Between the user interface and algorithms there is a constant relationship for correct operation. Communication passes through the use of decentralized platform protocols. When a user logs in, he works with a crypto-currency purse. It also responds to the user's actions, and then transmits the encrypted information via the Quickx protocol to the algorithmic system. In fact, the developed algorithms and user part for work - this is the project Quickx. As a result, a close relationship is formed between the crypto-currency purse, the user interface, the Quickx algorithm, the liquidity pool and the business environment.

By using innovative technologies, users are given the opportunity to make quick transactions. So, it's less time to spend on operational processes. Operations, according to the company, can only take a couple of seconds. In addition, all transactions are carried out at a very low price. The commissions on the platform are of a formal nature, but it allows to keep the platform "afloat".

Quickx technologies solve the problem of scalability. The site does not create restrictions for conducting transactions. The development team "throws" all the forces to ensure that the problem of blocking in the sphere of scalability is not expressed on the clients of the company.

TOKEN DISTRIBUTION

- 60%=>Token Sale

- 15%=>Liquidity Reserve

- 13%=>Founders & Team

- 5%=>Strategic Partnerships

- 5%=>Advisors

- 2%=>Bounty

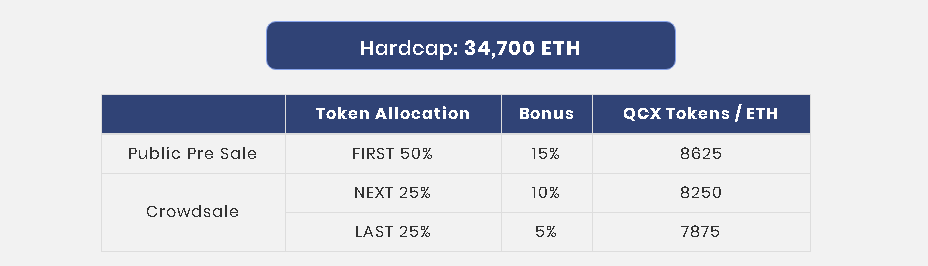

Available QCX for crowdfunding :250,000,000

Available QCX for Private Sale:50,000,000

Token price

1 ETH = 7500 QCX

Participation via ETH

- Quickx Decimals:8

- Symbol: QCX

- Type: Utility

- Blockchain: Ethereum ERC-20

BONUS ALLOCATION

ROADMAP

- 2016 Q3 Started Research in Blockchain

- 2017 Q1 Planning of Business Module and resource team allocation

- 2017 Q3 Patent Filed for the technology (QuickX)

- 2017 Q4 Raised $1.2 Mn from Private Investors to work on QuickX Protocol

- 2018 Q2 MVP Launch (Decentralized Multi Currency Wallet- Android Version)

- 2018 Q3 Token Sale Launch of Fully Functional Multicurrency Wallet (Android version)

- 2018 Q4QuickX Platform Testnet Launch (Internal)Launch of Multicurrency Wallet (iOS version)Launch of Multi currency Crypto Debit Card

- 2019 Q1Security Testing and Auditing of QuickX Platform TestnetPublic Launch on Testnet

- 2019 Q2Launch of V.1.0 on Mainnet with Public Liquidity reserve and Platform will be open for Pooling Facilitators to infuse LiquidityAddition of More Cryptocurrencies in Wallet and enhance User Experience

- 2019 Q3QuickX SDK and tools available for different wallets to implement and use features of QuickX protocolPartnership with more card providers in different Countries to increase user base

- 2019 Q4Instant Cryptocurrency Swap using QuickX ProtocolMarket Expansion and bringing more Blockchains to QuickX Platform

For more information :

WEBSITE: http://www.quickx.io/

FACEBOOK: https://facebook.com/quickxprotocol

TWITTER: https://twitter.com/Quickxprotocol

TELEGRAM: https://t.me/quickxprotocol

Bitcointalk Profile : https://bitcointalk.org/index.php?action=profile;u=1662391

ETH: 0xe1f377f5B1c2C537485Cf0558793b5d4b9c3569F

Tidak ada komentar:

Posting Komentar